8. Monetary Policy and the Fed & Government and Fiscal Policy¶

Monetary Policy 1¶

- Fed’s economy support included buying mortgage-backed securities to support the mortgage and housing markets, buying long-term Treasury bills, and creating other new credit facilities to make credit more easily available to households and small businesses.

- The Fed, however, both sets and carries out monetary policy.

- Deliberations about fiscal policy can drag on for months, even years, but the Federal Open Market Committee (FOMC) can, behind closed doors, set monetary policy in a day—and see that policy implemented within hours.

- The Fed’s primary goal appears to be the control of inflation. Providing that inflation is under control, the Fed will act to close recessionary gaps.

- Expansionary policy, such as a purchase of government securities by the Fed, tends to push bond prices up and interest rates down, increasing investment and aggregate demand. Contractionary policy, such as a sale of government securities by the Fed, pushes bond prices down, interest rates up, investment down, and aggregate demand shifts to the left.

- Recognition lag: The delay between the time a macroeconomic problem arises and the time at which policy makers become aware of it.

- Implementation lag: The delay between the time at which a problem is recognized and the time at which a policy to deal with it is enacted.

- Impact lag: The delay between the time a policy is enacted and the time that policy has its impact on the economy.

- Liquidity trap: Situation that exists when a change in monetary policy has no effect on interest rates.

- Macroeconomic policy makers must contend with recognition, implementation, and impact lags.

- Potential targets for macroeconomic policy include interest rates, money growth rates, and the price level or expected rates of change in the price level.

- To counteract liquidity traps, central banks have used quantitative-easing and credit-easing strategies.

- No central bank can know in advance how its policies will affect the economy; the rational expectations hypothesis predicts that central bank actions will affect the money supply and the price level but not the real level of economic activity.

Monetary and Fiscal Policy 2¶

Government and Fiscal Policy 3¶

- Some critics argued for a greater focus on tax cuts while others were concerned about whether the spending would focus on getting the greatest employment increase or be driven by political considerations.

Government and the Economy¶

- Government purchases:

- It includes all purchases by government agencies of goods and services produced by firms, as well as direct production by government agencies themselves.

- It is a component of aggregate demand; it includes all goods purchased or produced by government agencies.

- Examples: public schools expenditures, military expenditures, and highway construction.

- It constitutes of 20% (approximately) of the total GDP in the United States.

- Transfer payments:

- It is a provision of aid or money to individuals or families who are not expected to provide anything in return.

- Examples: Social Security, unemployment insurance, and welfare benefits.

- It increased rapidly during the 1960s and 1970s because of the establishment of Medicare and Medicaid.

- Medicare: Health insurance for the elderly.

- Medicaid: Health insurance for the poor.

- It rose from 6% of GDP in 1960 to 18% in 2010.

- It fluctuates with the business cycle; it increases during recessions and decreases during expansions.

- When economic activity falls, incomes fall, people lose jobs, and more people qualify for aid.

- People qualify to receive welfare benefits, such as cash, food stamps, or Medicaid, only if their income falls below a certain level.

- They qualify for unemployment compensation by losing their jobs. More people qualify for transfer payments during recessions.

- When the economy expands, incomes and employment rise, and fewer people qualify for welfare or unemployment benefits. Spending for those programs therefore tends to fall during an expansion.

- Net interest:

- Net interest includes payments of interest by governments at all levels on money borrowed, less interest earned on saving.

- It includes interest payments on the national debt.

- Texes:

- Taxes affect the relationship between real GDP and personal disposable income; they therefore affect consumption.

- They also influence investment decisions, as business tax affect the profitability of investments.

- Payroll taxes affects the cost of hiring workers, thus, they affect employment.

- So taxes affect consumption, investment, and employment, and therefore, real GDP.

- Federal level: Most taxes are from income taxes and payroll taxes.

- State and local levels: Most taxes are from sales taxes and property taxes.

- Both federal and state governments also collect taxes on corporate profits.

- Government Budget Balance:

- It is the difference between the government’s revenues and its expenditures.

- Budget surplus: When revenues exceed expenditures.

- Budget deficit: When expenditures exceed revenues.

- Balanced budget: When revenues equal expenditures.

- National debt:

- It is the sum of all past federal deficits, minus any surpluses.

- The U.S. national debt relative to its GDP is somewhat above average among developed nations.

Use of Fiscal Policy to Stabilize the Economy¶

- Fiscal policy is the use of government spending and taxes to influence the economy.

- Monetary policy is the manipulation of the money supply to influence the economy.

- Fiscal policy is the government counterpart to monetary policy.

- Fiscal policy aims to stabilize the economy by stimulating aggregate demand and close recessionary gaps.

- Automatic stabilizers:

- They are government programs that automatically reduce the fluctuations in GDP.

- They aim to insulate individuals from the impact of economic shocks.

- Transfer payments reduce the effects of a change in real GDP on disposable income; thus, when the income falls due to real GDP decrease, transfer payments tries to compensate for the loss.

- Income taxes also have the same effect; when income falls, people pay less in income taxes.

- Example: in the trough of 1990-1991 business cycle, real GDP fell by 1.6%, but disposable income fell by only 0.9% because of tax reductions and increased transfer payments that covered the loss of income.

- It is important to note that changes in expenditures and taxes that occur through automatic stabilizers do not shift the aggregate demand curve. Because they are automatic, their operation is already incorporated in the curve itself.

- Discretionary Fiscal policy tools:

- They are deliberate changes in government spending and taxes for other purposes that mat include aiming to reduce the fluctuations in GDP.

- Example: collect more taxes to increase defense spending.

- Such policies may affect real GDP and employment as a by-product, or as a primary goal.

- These policies shift the aggregate demand curve either to the right or to the left.

- Expansionary fiscal policy might consist of an increase in government purchases or transfer payments, a reduction in taxes, or a combination of these tools to shift the aggregate demand curve to the right.

- A contractionary fiscal policy might involve a reduction in government purchases or transfer payments, an increase in taxes, or a mix of all three to shift the aggregate demand curve to the left.

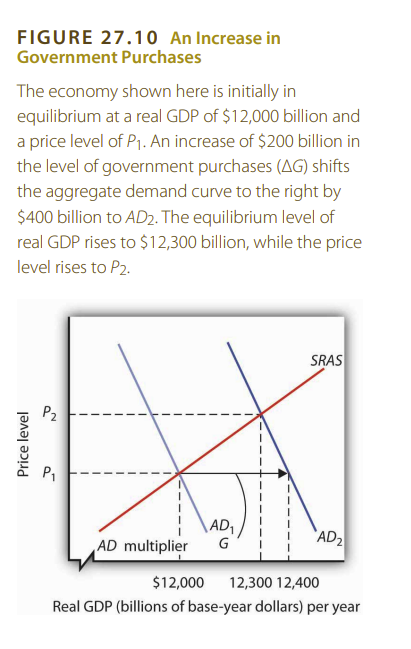

- Changes in Government Purchases:

- The demand curve shifts to the right by an amount equal to the initial change in government purchases times the multiplier.

- The increase in government purchases increases income, which in turn increases consumption. Then, part of the impact of the increase in aggregate demand is absorbed by higher prices, preventing the full increase in real GDP that would have occurred if the price level did not rise.

- A reduction in government purchases would have the opposite effect. The aggregate demand curve would shift to the left by an amount equal to the initial change in government purchases times the multiplier. Real GDP and the price level would fall.

- Changes in Business Taxes:

- An investment tax credit allows a firm to reduce its tax liability by a percentage of the investment it undertakes during a particular period.

- With an investment tax credit of 10%, for example, a firm that engaged in $1 million worth of investment during a year could reduce its tax liability for that year by $100,000.

- An investment tax credit is intended to stimulate additional private sector investment. A r**eduction in the tax rate on corporate profits** would be likely to have a similar effect.

- Conversely, an increase in the corporate income tax rate or a reduction in an investment tax credit could be expected to reduce investment.

- A change in investment affects the aggregate demand curve in precisely the same manner as a change in government purchases. It shifts the aggregate demand curve by an amount equal to the initial change in investment times the multiplier.

- An increase in the investment tax credit, or a reduction in corporate income tax rates, will increase investment and shift the aggregate demand curve to the right. Real GDP and the price level will rise.

- A reduction in the investment tax credit, or an increase in corporate income tax rates, will reduce investment and shift the aggregate demand curve to the left. Real GDP and the price level will fall.

- Changes in Income Taxes:

- Income taxes affect the consumption component of aggregate demand.

- An increase in income taxes reduces disposable personal income and thus reduces consumption (but by less than the change in disposable personal income). That shifts the aggregate demand curve leftward by an amount equal to the initial change in consumption that the change in income taxes produces times the multiplier.

- A reduction in income taxes increases disposable personal income, increases consumption (but by less than the change in disposable personal income), and increases aggregate demand.

- The shift in the aggregate demand curve due to an income tax cut is somewhat less, as is the effect on real GDP and the price level.

- Changes in Transfer Payments:

- Changes in transfer payments, like changes in income taxes, alter the disposable personal income of households and thus affect their consumption, which is a component of aggregate demand.

- Because consumption will change by less than the change in disposable personal income, a change in transfer payments of some amount will result in a smaller change in real GDP than would a change in government purchases of the same amount.

- Discretionary fiscal policy may be either expansionary or contractionary.

- Fiscal policies that could be used to close an inflationary gap include reductions in government purchases and transfer payments and increases in taxes.

Issues in Fiscal Policy¶

- Lags:

- Recognition lag: The time it takes for policy makers to recognize the existence of a problem.

- Implementation lag: The time it takes to put a policy into effect.

- Impact lag: The time it takes for a policy to have an effect on the economy.

- Crowding out:

- Because an expansionary fiscal policy either increases government spending or reduces revenues, it increases the government budget deficit or reduces the surplus.

- A contractionary policy is likely to reduce a deficit or increase a surplus.

- Crowding out: The tendency for an expansionary fiscal policy to reduce other components of aggregate demand.

- Crowding out reduces the effectiveness of any expansionary fiscal policy, whether it be an increase in government purchases, an increase in transfer payments, or a reduction in income taxes.

- Each of these policies increases the deficit and thus increases government borrowing.

- The supply of bonds increases, interest rates rise, investment falls, the exchange rate rises, and net exports fall.

- Crowding in:

- The reverse of crowding out occurs with a contractionary fiscal policy (a cut in government purchases or transfer payments, or an increase in taxes).

- Such policies reduce the deficit (or increase the surplus) and thus reduce government borrowing, shifting the supply curve for bonds to the left.

- Interest rates drop, inducing a greater quantity of investment. Lower interest rates also reduce the demand for and increase the supply of dollars, lowering the exchange rate and boosting net exports. This phenomenon is known as “crowding in.”

- Choice of Policy:

- Because the decision makers who determine fiscal policy are all elected politicians, the choice among the policy options available is an intensely political matter, often reflecting the ideology of the politicians.

- Supply-side economics: The school of thought that promotes the use of fiscal policy to stimulate long-run aggregate supply.

References¶

-

Rittenberg, L. & Tregarthen, T. (2009). Principles of Economics. Flat World Knowledge. Chapter 26: Monetary Policy. https://my.uopeople.edu/pluginfile.php/1894580/mod_book/chapter/527842/Principles%20Of%20Economics%20Chapter%2026.pdf ↩

-

Khan Academy. (2012, March 7). Monetary and fiscal policy | Aggregate demand and aggregate supply | Macroeconomics | Khan Academy [Video]. YouTube. https://youtu.be/ntxMOKXHlfo ↩

-

Rittenberg, L. & Tregarthen, T. (2009). Principles of Economics. Flat World Knowledge. Chapter 27: Government and Fiscal Policy. https://my.uopeople.edu/pluginfile.php/1894582/mod_book/chapter/527848/Principles%20Of%20Economics%20Chapter%2027.pdf ↩