7. Economic Growth & The Nature and Creation of Money¶

Economic Growth 1¶

- Of course, while economic growth can improve our material well-being, it is no panacea for all the ills of society. Americans today worry about the level of violence in society, environmental degradation, and what seems to be a loss of basic values. But while it is easy to be dismayed about many challenges of modern life, we can surely be grateful for our material wealth. Our affluence gives us the opportunity to grapple with some of our most difficult problems and to enjoy a range of choices that people only a few decades ago could not have imagined.

- Increases in potential constitute economic growth.

- Real GDP fluctuates about potential output.

- Real GDP sagged well below its potential during the Great Depression of the 1930s and rose well above its potential as the nation mobilized its resources to fight World War II.

- Over time, small differences in growth rates create large differences in incomes.

- Exponential growth: When a quantity grows at a given percentage rate.

- Rule of 72: A variable’s approximate doubling time equals 72 divided by the growth rate, stated as a whole number.

- Output per capita: Real GDP per person.

% rate of growth of output per capita ≅ % rate of growth of output − % rate of growth of population.- For economic growth to translate into a higher standard of living on average, economic growth must exceed population growth.

- Aggregate production function: Function that relates the total output of an economy to the total amount of labor employed in the economy, all other determinants of production (capital, natural resources, and technology) being unchanged.

- Diminishing marginal returns: Situation that occurs when additional units of a variable factor add less and less to total output, given constant quantities of other factors.

- Productivity: The amount of output per worker.

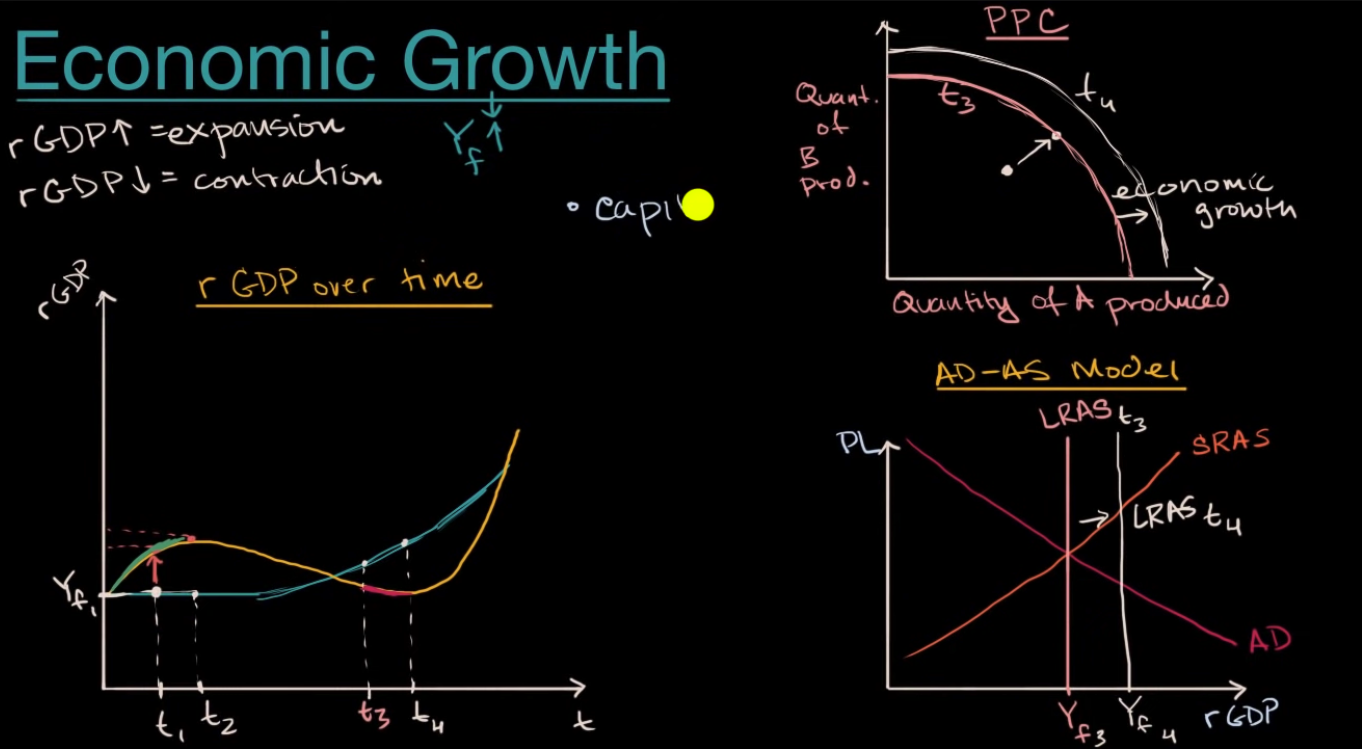

Understanding Economic Growth 2¶

- Economic growth:

- The expansion of output of an economy over time, that is, increase in real GDP.

- The increase in full-employment output of an economy over time.

- A push outward of the production possibilities curve.

- Long-run aggregate supply curve shifts to the right.

- Notes:

- Real GDP increase = Expansion of output.

- Real GDP decrease = Contraction of output.

- Full-employment output (Y_f) increase = Economic growth.

- Causes of economic growth:

- More capital: land, resources, and labor.

- Human capital: better educated and trained workers.

- Technology advancement: new and better ways of producing goods and services.

- Institutions: bureaucratic efficiency, property rights, and rule of law.

Aggregate Demand and Aggregate Supply 3¶

- Time for a lot of fixed costs and fixed prices to adjust, change, or expire.

- Aggregate supply in long term is vertical, that is, it does not depend on the price level.

- Shifters of the long-run aggregate supply curve:

- Population increase: more people, more labor, more production => more GDP.

- Technology advancements: more technology, more production => more GDP.

- Resource availability: more resources discovered, more production => more GDP.

- Low unemployment: more people working, more production => more GDP.

- War: population decrease or factories destroyed, less production => less GDP.

The Nature and Creation of Money 4¶

- Money: Anything that serves as a medium of exchange.

- Medium of exchange: Anything that is widely accepted as a means of payment.

- Functions of money:

- Medium of exchange:

- Without money, we would have to barter.

- Barter: The exchange of goods and services for other goods and services.

- Double coincidence of wants: The unlikely occurrence that two people each have a good or service that the other wants.

- Money eliminates the need for double coincidence of wants.

- Money makes exchange easier and more efficient, flexible, convenient, orderly, automatic, impersonal, anonymous, secure, private, universal, continuous, divisible, portable, durable, stable, uniform, acceptable, reliable, predictable, trustworthy, standardized, consistent.

- Unit of account:

- Unit of account: A consistent means of measuring the value of things.

- A standard unit in which prices can be stated and the value of goods and services can be compared.

- Money makes it easier to compare the value of goods and services, over time, across different markets, and across different countries.

- Store of value:

- Store of value: An item that holds value over time.

- Money is a way to store wealth, purchasing power, for the future, for emergencies, for retirement, and for education.

- Money, of course, is not the only thing that stores value. Houses, office buildings, land, works of art, and many other commodities serve as a means of storing wealth and value

- Money is directly exchangeable as opposed to other stores of value.

- Medium of exchange:

- Types of money:

- Commodity money:

- Money that has intrinsic value.

- Money that has value apart from its use as money.

- E.g. gold, silver, copper, salt, cigarettes, shells, beads, and other commodities.

- Gold can be used as jewelry or as a monetary metal.

- Disadvantages of commodity money:

- Its quantity is can change radically (either increase or decrease); E.g. when new mines are discovered or when new technologies are developed to produce more of it.

- Its quality is variable; E.g. pure gold is more valuable than impure gold.

- Gresham’s law: the tendency for a lower-quality commodity (bad money) to drive a higherquality commodity (good money) out of circulation.

- Fiat money:

- Money that has no intrinsic value.

- Money that is decreed by the government to be accepted in payment of debts or medium of exchange.

- Currency: coins and paper money.

- Checkable deposits:

- Money that has no intrinsic value.

- Money that can be converted to currency on demand, as they are not currency themselves.

- Money that can be withdrawn from a bank on demand by writing a check.

- Check: A written order to a bank to pay the amount specified to the person or organization named on it.

- Debit cards are the electronic version of checks.

- Notice that it is the checkable deposit, not the check or debit card, that is money.

- Commodity money:

- Money supply: The total quantity of money in the economy at any one time.

- Liquidity: The ease with which an asset can be converted into currency.

- Before 1980, the basic money supply was measured as the sum of currency in circulation, traveler’s checks, and checkable deposits.

- Now, Money Supply is:

- Base money (MB): Currency in circulation + reserves of banks at the central bank.

- M1: MB + checkable deposits + traveler’s check; perfectly liquid.

- M2: M1 + saving accounts + small time deposits + money market mutual funds (by individuals); highly liquid.

- M3: M2 + large time deposits + large money market mutual funds (by institutions); less liquid; not included in the official measures of money supply.

- Financial intermediary: An institution that amasses funds from one group and makes them available to another.

- Bank: A financial intermediary that accepts deposits, makes loans, and offers checking accounts.

- Other intermediaries: Retirement funds, insurance companies, mutual funds, and finance companies.

Bank Finance and a Fractional Reserve System¶

- Balance sheet: A financial statement showing assets, liabilities, and net worth.

- Assets: Anything of value.

- Liabilities: Obligations to other parties.

- Net worth Assets less liabilities.

- Reserves: Bank assets held as cash in vaults and in deposits with the Federal Reserve.

- Fractional reserve banking system: System in which banks hold reserves whose value is less than the sum of claims outstanding on those reserves.

- The sum of liabilities plus net worth therefore must equal the sum of all assets.

- Required reserves: The quantity of reserves banks are required to hold.

- Required reserve ratio: The ratio of reserves to checkable deposits a bank must maintain.

- Excess reserves: Reserves in excess of the required level.

- Loaned up: When a bank’s excess reserves equal zero.

- Total reserves: Required reserves + excess reserves.

- Banks create money when they issue loans, but no one bank ever seems to keep the money it creates. That is because money is created within the banking system, not by a single bank.

- With a 10% reserve requirement, each dollar in reserves backs up $10 in checkable deposits.

- Deposit multiplier: The ratio of the maximum possible change in checkable deposits (∆D) to the change in reserves (∆R).

- The Regulation of Banks:

- Deposit insurance:

- A system that guarantees that depositors will not lose money even if their bank goes bankrupt.

- The Federal Deposit Insurance Corporation (FDIC) insures deposits up to $250,000 for each account.

- This guarantee may encourage banks to take on more risk than they would otherwise.

- This guarantee may encourage depositors to be less careful about where they put their money.

- A bank can operate only if customers maintain confidence in it.

- Losing confidence in a bank can lead to a bank run.

- Regulation fo prevent bank failure:

- Banks are prevented from making certain types of risky investments.

- Banks are required to maintain a certain amount of net worth.

- FDIC audits banks regularly.

- Deposit insurance:

Federal Reserve System¶

- Central bank: A bank that acts as a banker to the central government, acts as a banker to banks, acts as a regulator of banks, conducts monetary policy, and supports the stability of the financial system.

- Congress passed the Federal Reserve Act in 1913, creating the Fed and giving it all the powers of a central bank.

- Fed structure:

- In an effort to decentralize power, Congress designed the Fed as a system of 12 regional banks.

- Each of these banks operates as a kind of bankers’ cooperative; the regional banks are owned by the commercial banks in their districts that have chosen to be members of the Fed.

- The owners of each Federal Reserve bank select the board of directors of that bank; the board selects the bank’s president.

- The board of directors for the entire Federal Reserve System is called the Board of Governors.

- The seven members of the board are appointed by the president of the United States and confirmed by the Senate for 14-year terms.

- The chairman of the board is appointed by the president for a four-year term.

- Powers of the Fed:

- Setting reserve requirements:

- Fed can raise reserve requirements to reduce the money supply or lower them to increase the money supply.

- It is not used as it makes banking harder, and banks needs to plan their loans and investments.

- Setting the discount window and other credit facilities:

- Discount rate: The interest rate charged by the Fed when it lends reserves to banks.

- Federal funds market: A market in which banks lend reserves to one another.

- Federal funds rate: The interest rate charged when one bank lends reserves to another.

- Do open market operations:

- Open market operations: The buying and selling of government securities (bonds) by the Fed.

- Bond: A promise by the issuer of the bond to pay the owner of the bond a payment or a series of payments on a specific date or dates.

- The Fed buys securities to increase the money supply and sells securities to decrease the money supply.

- The issued bonds do not require the amount to be taking out of the money in circulation.

- The Fed buys bonds, that is, it creates money and deposits it in the bank accounts of the sellers of the bonds.

- The Fed sells bonds, that is, it collects money from the buyers of the bonds and destroys it.

- Setting reserve requirements:

What is Money? 5¶

- Money is a widely accepted medium of exchange.

- Anything that can be used to buy goods and services.

- Currency: coins and paper money is a type of money.

- Checking accounts: a type of money.

- Saving accounts: you can’t use them to buy goods and services directly, but you can convert them to currency.

- Money market mutual funds: a type of money.

- Jewelry, goods: can be sold and converted to currency; they are NOT a type of money because selling takes time and effort and you don’t know how much you will get.

- Most liquid to least liquid:

- Currency.

- Checking accounts.

- Saving accounts.

- Money market mutual funds.

- Jewelry, goods.

- Money:

- Any widely used method of payment.

- Any asset that be easily converted to a widely used method of payment with little loss of value.

- Money Supply:

- MB: Monetary Base: Currency in circulation + reserved deposits by banks at the central bank.

- M1: Currency in circulation + checkable deposits(checking accounts).

- M2: M1 + saving accounts + small time deposits + money market mutual funds.

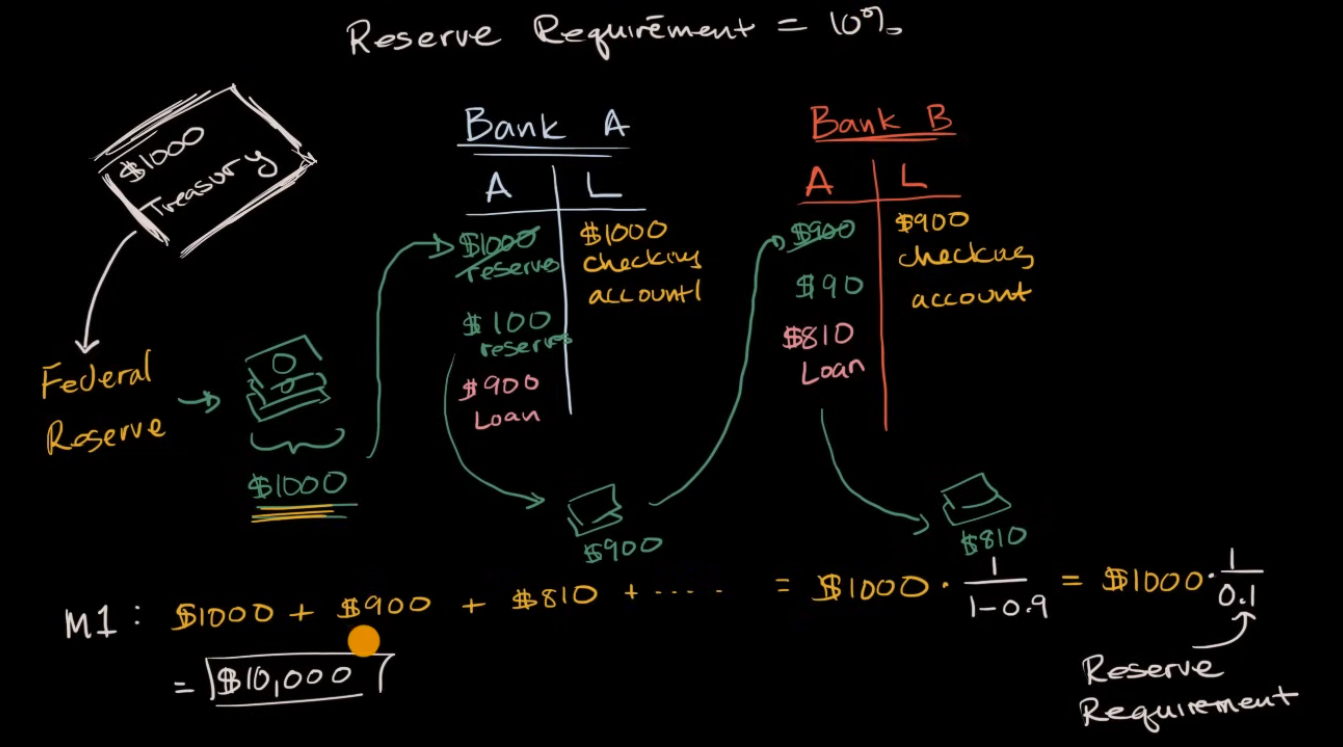

Money Creation in a Fractional Reserve System 6¶

- Fractional Reserve System:

- Banks keep a fraction of deposits as reserves.

- The rest of the deposits are loaned out.

- The money supply is increased.

- The money supply is increased by the money multiplier.

- Money multiplier = 1 / reserve requirement.

- Example:

- Reserve requirement = 10%.

- Deposit = $100.

- Bank keeps $10 as reserves.

- Bank loans out $90.

- The borrower deposits $90 in another bank.

- The second bank keeps $9 as reserves.

- The second bank loans out $81.

- The process continues.

- The total money supply = $100 + $90 + $81 + … = $100 * (1/0.1) = $100 * 10 = $1000.

References¶

-

Rittenberg, L. & Tregarthen, T. (2009). Principles of Economics. Flat World Knowledge. Chapter 23: Economic Growth. https://my.uopeople.edu/pluginfile.php/1894571/mod_book/chapter/527830/Principles%20Of%20Economics%20Chapter%2023.pdf ↩

-

Khan Academy. (2018, April 13). Understanding economic growth | AP Macroeconomics | Khan Academy [Video]. YouTube. https://youtu.be/khDAji7dXw0 ↩

-

Khan Academy. (2012, March 2). Long-run aggregate supply | Aggregate demand and aggregate supply | Macroeconomics | Khan Academy [Video]. YouTube. https://youtu.be/8W0iZk8Yxhs ↩

-

Rittenberg, L. & Tregarthen, T. (2009). Principles of Economics. Flat World Knowledge. Chapter 24: The Nature and Creation of Money. https://my.uopeople.edu/pluginfile.php/1894576/mod_book/chapter/527836/Principles%20Of%20Economics%20Chapter%2024.pdf ↩

-

Marginal Revolution University. (2017, July 18). What is money? [Video]. YouTube. https://youtu.be/r5eFObOFcME ↩

-

Khan Academy. (2018, March 12). Money creation in a fractional reserve system | Financial sector | AP Macroeconomics | Khan Academy [Video]. YouTube. https://youtu.be/gd8B-zrMSYk ↩