3. The Analysis of Consumer Choice & Production and Cost¶

The Analysis of Consumer Choice 1¶

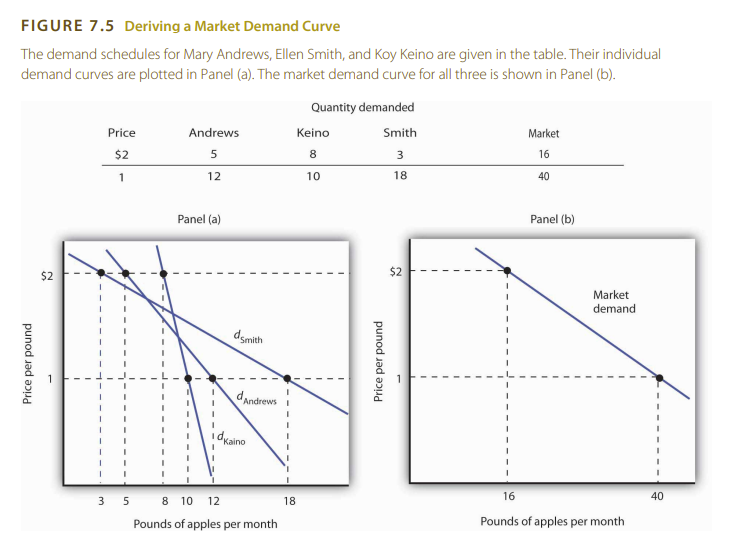

- The model of utility theory that economists have constructed to explain consumer choice assumes that consumers will try to maximize their utility.

- Utility theory provides insights into demand. It lets us look behind demand curves to see how utility-maximizing consumers can be expected to respond to price changes.

The Concept of Utility¶

- The concept of utility is an elusive one as it measures the satisfaction that consumers derive from consuming goods and services.

- Utility is not in the good itself but in the mind of the consumer.

- Total utility: The number of units of utility that a consumer gains from consuming a given quantity of a good, service, or activity during a particular time period.

- The rate of increase is given by the slope of the total utility curve.

- Marginal utility: The amount by which total utility rises with consumption of an additional unit of a good, service, or activity, all other things unchanged.

- Law of diminishing marginal utility: This tendency of marginal utility to decline beyond some level of consumption during a period.

- Failure of marginal utility to diminish would thus lead to extraordinary levels of consumption of a single good to the exclusion of all others.

- Budget constraint: A restriction that total spending cannot exceed the budget available.

- To simplify our analysis, we shall assume that a consumer’s spending in any one period is based on the budget available in that period. In this analysis consumers neither save nor borrow.

- Utility maximization is a matter of arranging that spending to achieve the highest total utility possible.

- The marginal decision rule states that an activity should be expanded if its marginal benefit exceeds its marginal cost.

- The marginal benefit of this activity is the utility gained by spending an additional $1 on the good.

- The marginal cost is the utility lost by spending $1 less on another good.

- Utility-maximizing condition: Utility is maximized when total outlays equal the budget available and when the ratios of marginal utilities to prices are equal for all goods and services.

- If we are to apply the marginal decision rule to utility maximization, goods must be divisible; that is, it must be possible to buy them in any amount.

Utility Maximization and Demand¶

- Choices that maximize utility -that is, choices that follow the marginal decision rule- generally produce downward-sloping demand curves.

- Income-compensated price change: An imaginary exercise in which we assume that when the price of a good or service changes, the consumers income is adjusted so that he or she has just enough to purchase the original combination of goods and services at the new set of prices.

- Substitution effect: The change in a consumers consumption of a good in response to an income-compensated price change.

- The substitution effect always involves a change in consumption in a direction opposite that of the price change.

- When a consumer is maximizing utility, the ratio of marginal utility to price is the same for all goods.

- An income-compensated price reduction increases the extra utility per dollar available from the good whose price has fallen; a consumer will thus purchase more of it.

- An income-compensated price increase reduces the extra utility per dollar from the good; the consumer will purchase less of it.

- When the price of a good goes up, people react to the higher price by substituting or switching away from that good, buying less of it and instead buying more of other goods.

- Income effect: The change in consumption of a good resulting from the implicit change in income because of a price change.

- When the price of a good rises, there is an implicit reduction in income.

- When the price of a good falls, there is an implicit increase.

- When the price of apples fell, Ms. Andrews (who was consuming 5 pounds of apples per month) received an implicit increase in income of $5.

- When the price of a good falls, the demand increases because of two effects: substitution and income effects.

- When the price of a normal good falls, there are two identifying effects:

- 1- The substitution effect contributes to an increase in the quantity demanded because consumers substitute more of the good for other goods.

- 2- The reduction in price increases the consumer’s ability to buy goods. Because the good is normal, this increase in purchasing power further increases the quantity of the good demanded through the income effect.

- Both effects work in the same direction, so the quantity demanded increases.

- When the price of an inferior good falls, two things happen:

- 1- Consumers will substitute more of the inferior good for other goods because its price has fallen relative to those goods. The quantity demanded increases as a result of the substitution effect.

- 2- The lower price effectively makes consumers richer. But, because the good is inferior, this reduces quantity demanded.

- Both effects work in different directions, substitution effect increases quantity demanded, and the income effect decreases it.

Indifference Curve Analysis¶

- Budget line: Graphically shows the combinations of two goods a consumer can buy with a given budget.

P1Q1 + P2Q2 ≤ Bwhere P is prices, Q is quantities, and B is the budget.Slope = -P2/P1where P1 is the good on horizontal (x) axis and P2 is the good on the vertical (y) axis.- Indifference curve: Graph that shows combinations of two goods that yield equal levels of utility.

- There are an infinite number of indifference curves, each representing a different level of utility.

- Every point below and left the indifference curve gives less utility, and every point above and right gives more utility.

- Points below the curve are attainable but less preferred, and points above the curve are unattainable in the budget constraint.

- Every point on the curve gives the same level of utility.

- The marginal rate of substitution is equal to the absolute value of the slope of an indifference curve. It is the maximum amount of one good a consumer is willing to give up to obtain an additional unit of another.

- We assume that each consumer seeks the highest indifference curve possible.

Consumer Theory 2¶

Introduction to Utility 3¶

- Utility in real life is:

- The measure of usefulness that a consumer obtains from any good or service.

- It may measure worth, value, or satisfaction.

- Marginal utility is the additional utility a consumer gets from consuming one more unit of a good or service.

| scopes of ice cream | total utility (utils) | marginal utility (utils) |

|---|---|---|

| 0 | 0 | |

| 1 | 10 | 10 |

| 2 | 18 | 8 |

| 3 | 24 | 6 |

| 4 | 20 | -4 |

| 5 | 14 | -6 |

- Utility increases as the quantity of a good consumed increases, until a certain point, where it starts to decrease.

- Marginal utility starts up positive, but eventually decreases.

Marginal Utility 4¶

- The law of diminishing marginal utility states that as a person consumes more of a good, the additional satisfaction from each additional unit of the good decreases.

- The marginal utility curve is downward sloping.

- Utility units are arbitrary and cannot be compared across individuals, but they are relative to each other.

- You can add the prices of goods to the utility to get the marginal utility per dollar of each good.

Indifference Curves and Marginal Rate of Substitution 5¶

- It draws a curve that shows the combinations of two goods that give the consumer the same level of satisfaction.

- Quantity of good 1 on the x-axis and quantity of good 2 on the y-axis, each point on the curve gives the same level of satisfaction.

- The level of satisfaction is computed as the area of the rectangle trapped by point on the curve and the origin.

- Every point on the curve gives the same level of satisfaction.

- Every point lower than the curve gives less satisfaction, and every point above the curve is impossible to reach.

- Marginal rate of substitution is the rate at which a consumer is willing to trade one good for another, and it is the slope of the indifference curve at that point.

Production and Cost 6¶

- Should a good or service be produced using relatively more labor and less capital? Or should relatively more capital and less labor be used? What about the use of natural resources?

- Short run: A planning period over which the managers of a firm must consider one or more of their factors of production as fixed in quantity.

- Fixed factor of production: A factor of production whose quantity cannot be changed during a particular period.

- Variable factor of production: A factor of production whose quantity can be changed during a particular period.

- Long run: The planning period over which a firm can consider all factors of production as variable.

- Production function: The relationship between factors of production and the output of a firm.

- Total product curve: Graph that shows the quantities of output that can be obtained from different amounts of a variable factor of production, assuming other factors of production are fixed.

The Short Run¶

- Marginal product: The amount by which output rises with an additional unit of a variable factor.

- Marginal product of labor (MPL): The amount by which output rises with an additional unit of labor. (ΔQ/ ΔL)

- Average product: The output per unit of variable factor.

- Average product of labor: The ratio of output to the number of units of labor (Q/ L).

- Increasing marginal returns: The range over which each additional unit of a variable factor adds more to total output than the previous unit.

- Diminishing marginal returns: The range over which each additional unit of a variable factor adds less to total output than the previous unit.

- Negative marginal returns: The range over which additional units of a variable factor reduce total output, given constant quantities of all other factors.

- Law of diminishing marginal returns: The marginal product of any variable factor of production will eventually decline, assuming the quantities of other factors of production are unchanged.

Marginal Cost, Average Variable Cost, and Average Total Cost 7¶

- MPL: Marginal Product of Labor, the additional output produced by one more unit of labor.

- MC: Marginal Cost, the additional cost of producing one more unit of output.

- AVC: Average Variable Cost, the variable cost per unit of output.

- AFC: Average Fixed Cost, the fixed cost per unit of output.

- ATC: Average Total Cost, the total cost per unit of output.

- TVC: Total Variable Cost, the variable cost of producing a given quantity of output.

- TFC: Total Fixed Cost, the fixed cost of producing a given quantity of output.

- TC: Total Cost, the sum of total variable cost and total fixed cost.

Video Resources 8¶

- Total Cost = Total Fixed Cost + Total Variable Cost.

- Marginal Cost is the change in total cost from producing one more unit of output = Total Cost / Quantity.

- Individual Costs:

- AVC: Average Variable Cost = Total Variable Cost / Quantity.

- AFC: Average Fixed Cost = Total Fixed Cost / Quantity.

- ATC: Average Total Cost = Total Cost / Quantity. ATC = AVC + AFC.

- Marginal product of labor (MPL) is the additional output produced by one more unit of labor.

- Marginal Product of capital (MPK) is the additional output produced by one more unit of capital.

References¶

-

Rittenberg, L. & Tregarthen, T. (2009). Principles of Economics. Flat World Knowledge. Chapter 7: The Analysis of Consumer Choice. https://saylordotorg.github.io/text_principles-of-economics-v2.0/index.html ↩

-

McAfee, R. P., Lewis, T. R., & Dale, D. D. (2014). Introduction to Economic Analysis. Chapter 12: Consumer Theory. https://saylordotorg.github.io/text_introduction-to-economic-analysis/s13-consumer-theory.html ↩

-

Khan Academy. (2018, October 19). Introduction to utility | APⓇ Microeconomics | Khan Academy [Video]. YouTube https://youtu.be/UnX8RPB5vFM ↩

-

Khan Academy. (2012, January 16). Marginal utility [Video]. YouTube https://youtu.be/Kf9KhwryQNE ↩

-

Khan Academy. (2019, April 16). Indifference curves and marginal rate of substitution | Microeconomics | Khan Academy [Video]. YouTube https://youtu.be/7G4BUm7M6MY ↩

-

Rittenberg, L. & Tregarthen, T. (2009). Principles of Economics. Flat World Knowledge. Chapter 8: Production and Cost. https://my.uopeople.edu/pluginfile.php/1894538/mod_book/chapter/527782/Principles%20Of%20Economics%20Chapter%2008.pdf ↩

-

Khan Academy. (2018, November 30). Marginal cost, average variable cost, and average total cost | APⓇ Microeconomics | Khan Academy [Video]. YouTube https://youtu.be/mW6Cwpfb5CI ↩

-

Clifford, J. (2014). Short-Run Costs (Part 1)- Micro Topic 3.2 [YouTube Video]. In YouTube. https://www.youtube.com/watch?v=ucJBO9UTmwo ↩