5. The World of Imperfect Competition & Macroeconomics¶

The World of Imperfect Competition 1¶

- Given how really fast the Internet changes, it comes as no surprise that the line between competition and cooperation is sometimes blurry.

- Imperfect competition: A market structure with more than one firm in an industry in which at least one firm is a price setter.

- An imperfectly competitive firm has a degree of monopoly power, either based on product differentiation that leads to a downward-sloping demand curve or resulting from the interaction of rival firms in an industry with only a few firms.

Monopolistic Competition: Competition among Many¶

- The model for monopolistic assumptions:

- Large number of firms.

- Easy entry and exit.

- Goods and services are differentiated by: advertising, convenience of location, quality, reputation of the seller, and other factors.

- Product differentiation gives firms producing a particular product some degree of price-setting or monopoly power, but this power is limited by the availability of close substitutes.

- No interdependence among firms.

- Very limited degree of price-setting power.

- Each firm is so small relative to the market that the market ignores what the firm does.

- Each firm responds to the market changes, not the actions of other firms.

- Each firm responds to its own demand, not the actions of other firms.

- Examples of monopolistic competitions:

- Restaurants.

- Retail stores.

- Barbershops.

- Beauty salons.

- Auto repair shops.

- Service stations.

- Banks.

- Accounting firms.

- Law firms.

- Profit maximization (Short run):

- Example: Restaurant: It can raise its price to certain levels, as it provides a unique dining experience that customers are willing to pay for.

- Differentiated markets imply that the notion of a single “market price” is meaningless.

- In the short run, the model of monopolistic competition looks exactly like the model of monopoly.

- Profit maximization (Long run):

- The assumption of easy entry and exit in monopolistic competition, entry will eliminate any economic profits in the long run.

- Positive economic profits will encourage new firms to enter the market, then the availability of close substitutes will increase, and the demand curve will shift to the left as new entrants take away some of the original firm’s customers and demand.

- The firm’s demand curve will become more price elastic, that is, demand will become more responsive to price changes.

- The demand will keep shifting to the left until the firm’s economic profit is zero, that is, price equals average total cost.

- As economic profit is zero at the long-run equilibrium, the firm will earn a normal profit, which is the minimum profit necessary to keep the firm in that line of business.

- As economic profit is zero at the long-run equilibrium, there is no incentive for firms to either enter or leave the industry.

- Excess Capacity: The Price of Variety:

- Situation in which a firm operates to the left of the lowest point on its average total cost curve.

- Because monopolistically competitive firms charge prices that exceed marginal cost, monopolistic competition is inefficient.

Oligopoly: Competition among the Few¶

- Oligopoly: A market structure in which a market is dominated by a few firms, each of which recognizes that its own actions will produce a response from its rivals and that those responses will affect it.

- In July, 2005, General Motors Corporation (GMC) offered “employee discount pricing” to virtually all GMC customers, not just employees and their relatives. This new marketing strategy introduced by GMC obviously affected Ford, Chrysler, Toyota and other automobile and truck manufacturers.

- The model for oligopoly assumptions:

- Few firms.

- Interdependence:

- Each firm recognizes that its own actions will produce a response from its rivals and that those responses will affect it.

- This contrasts both perfect competition and monopolistic competition, where firms are price takers.

- Each firm has more price-setting power than a monopolistically competitive firm, but less than a monopolist.

- Each firm must consider the reactions of its rivals when making decisions.

- Each firm is relatively large compared to the market, that is, the firm’s actions can affect the market as a whole.

- Each firm responds to the actions of other firms, as their actions can not be ignored due to their size.

- The demand of each firm is greatly affected by the actions of other firms, thus, firms must consider rival’s demand as well as their own.

- Entry and exit barriers are high.

- Differentiated or homogeneous products.

- Examples of oligopolies:

- Automobile industry.

- Airline industry.

- Soft drink industry.

- Breakfast cereal industry.

- Computer industry.

- Steel industry.

- Aluminum industry.

- Oil industry.

- Telecommunications industry.

- Pharmaceutical industry.

- Measuring Concentration in Oligopoly:

- Concentration ratio: The percentage of output accounted for by the largest firms in an industry.

- The cereal market is dominated by two firms, Kellogg’s and General Mills, which together hold more than half the cereal market.

- The market for ice cream, where the four largest firms account for just less than a third of output.

- Cereal market is more concentrated than the ice cream market.

- The higher the concentration ratio, the more the firms in the industry take account of their rivals’ behavior.

- The lower the concentration ratio, the more the industry reflects the characteristics of monopolistic competition or perfect competition.

- Herfindahl-Hirschman Index (HHI): An alternative measure of concentration found by squaring the percentage share (stated as a whole number) of each firm in an industry, then summing these squared market shares.

- The largest score is (100)^2 = 10,000, and the smallest is 0.

- Industry with two firms, each with 50% of the market, has an HHI of (50)^2 + (50)^2 = 2,500 + 2,500 = 5,000.

- Industry with 10,000 firms, each with 0.01% of the market, has an HHI of (0.01)^2 + (0.01)^2 + … + (0.01)^2 = 0.0001 + 0.0001 + … + 0.0001 = 1.

- The Collusion Model:

- Uncertainty about the interaction of rival firms makes specification of a single model of oligopoly impossible.

- Economists have devised a variety of models that deal with the uncertain nature of rivals’ responses in different ways: the collusion and game theory models.

- Firms in any industry could achieve the maximum profit attainable if they all agreed to select the monopoly price and output and to share the profits.

- Duopoly: An oligopoly with two firms.

- Overt collusion: When firms openly agree on price, output, and other decisions aimed at achieving monopoly profits.

- Cartel: Firms that coordinate their activities through overt collusion and by forming collusive coordinating mechanisms.

- OPEC is an example of a cartel.

- Tacit collusion: An unwritten, unspoken understanding through which firms agree to limit their competition.

- Game Theory and Oligopoly Behavior:

- Strategic choice: A choice based on the recognition that the actions of others will affect the outcome of the choice and that takes these possible actions into account.

- Game theory: An analytical approach through which strategic choices can be assessed.

- Payoff: The outcome of a strategic decision.

- Among the strategic choices available to an oligopoly firm are pricing choices, marketing strategies, and product-development efforts.

- Dominant strategy:

- A strategy that is best for a firm, no matter what strategies other firms use.

- The player’s best strategy is the same regardless of the strategies chosen by other players.

- Dominant strategy equilibrium:

- An equilibrium in which each firm’s dominant strategy results in the best possible outcome for all the firms.

- A game where each player has a dominant strategy.

- An oligopoly game is a bit like a baseball game with an unlimited number of innings—one firm may come out ahead after one round, but another will emerge on top another day.

- Tit-for-tat strategy: Situation in which a firm responds to cheating by cheating, and responds to cooperative behavior by cooperating; cheating on agreements becomes less and less likely.

- Trigger strategy Situation: in which a firm makes clear that it is willing and able to respond to cheating by permanently revoking an agreement.

Advertising¶

Price Discrimination¶

Monopolistic Competition and Economic Profit 2¶

- Monopolistic competition is a type of imperfect competition market structure in which a large number of firms produce similar but not identical products, this substitutes may eat the demand for the original product.

- Monopolistic competition is more closer to perfect competition than monopoly.

- It is hard for monopolistic competition firms to make economic profit in the long run because of the low barriers to entry and the fact that the products are similar but not identical.

- Example: Apple is a monopoly for IPad (only Apple produces IPad) but it is a monopolistic competition for Tablets in general (many companies create tablets that are substitutes or similar to IPad, but not identical).

- With more firms entering the market, the demand for the original product decreases, and the economic profit decreases as well.

- The demand curve shifts to the left, the marginal revenue curve shifts to the left, and the economic profit decreases until it reaches zero.

- Economic profit is the difference between total revenue and total cost, including both explicit and implicit costs.

- Accounting profit is the difference between total revenue and total explicit costs.

- While economic profit goes to zero, accounting profit can still be positive.

- The curves for the company that is in monopolistic competition are similar to the curves for a monopoly, as other companies are not producing the same product.

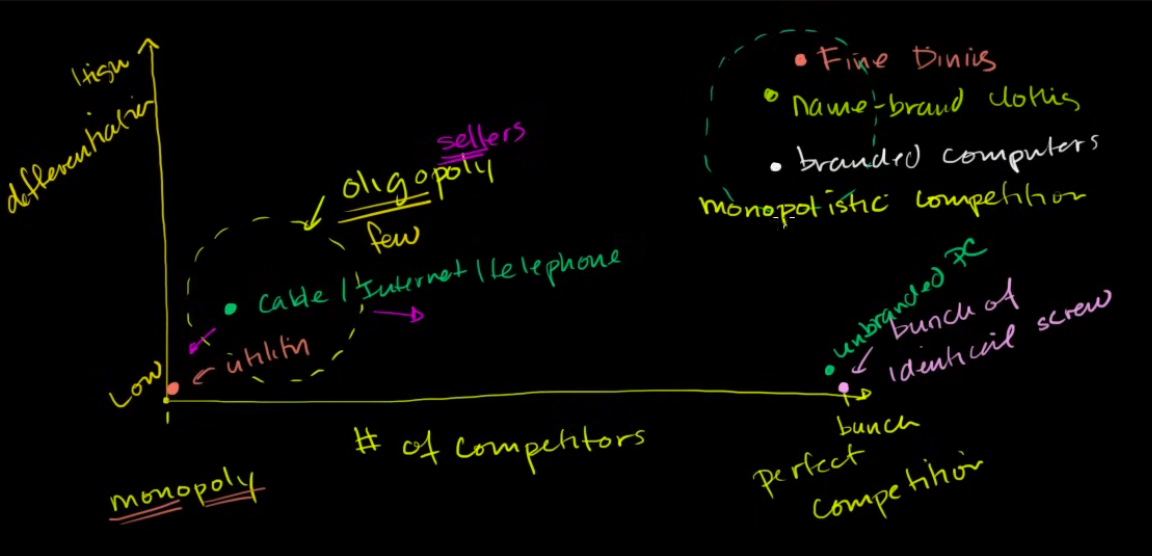

Oligopolies and Monopolistic Competition 3¶

- Oligopoly is a market structure in which a small number of firms have the large majority of the market share, all producing similar but not identical products.

- Oligopoly is more similar to monopoly than monopolistic competition.

- Oligopoly firms have a high degree of market power, but they are not price makers like monopolies (they can’t set the price).

- Oligopoly firms are interdependent, meaning that they have to consider the actions of other firms when making decisions.

- Oligopoly firms can collude to act like a monopoly, but this is illegal in most countries.

- Oligopoly firms can also compete with each other, but this can lead to a price war, which is not beneficial for any of the firms.

- Example: The airline industry is an oligopoly, with a few companies controlling the majority of the market share.

- The

yaxis: Differentiation: How similar, identical, or different the products are. - The

xaxis: Number of firms: How many firms are in the market. - Low differentiation means that the products are similar or identical, while high differentiation means that the products are different.

| Low Differentiation | High Differentiation | |

|---|---|---|

| Few Firms | Oligopoly | Monopoly (Each company is a monopoly for its product and no competitors) |

| Many Firms | Perfect Competition | Monopolistic Competition (Each company is a monopoly for its product but competitors are selling substitutes) |

Price Discrimination 4¶

- Price discrimination is the practice of charging different prices to different customers for the same product.

- Price discrimination is possible when the seller has market power, meaning that they can set the price.

- Price discrimination can increase the seller’s profit by capturing more consumer surplus.

- Example: Airlines charge different prices for the same seat depending on when the ticket is purchased, the time of the flight, and other factors.

- Depending on the consumer’s willingness to pay, the seller can charge different prices to different consumers.

Macroeconomics: The Big Picture 5¶

- Output, employment, and the price level are the key variables in the study of macroeconomics, which is the analysis of aggregate values of economic variables.

- Healthy country means its output is growing, its price level stable, and its unemployment rate low.

GDP and the Business Cycle¶

- Real GDP: The total value of all final goods and services produced during a particular year or period, adjusted to eliminate the effects of changes in prices.

- Nominal GDP: The total value of final goods and services for a particular period valued in terms of prices for that period.

- Business cycle: The economy’s pattern of expansion, then contraction, then expansion again.

- Expansion: A sustained period in which real GDP is rising.

- Recession: A sustained period in which real GDP is falling.

- Peak: The point of the business cycle at which an expansion ends and a recession begins.

- Trough: The point of the business cycle at which a recession ends and an expansion begins.

- Only final goods and services are included in GDP, not intermediate goods as this would lead to double counting.

- Typically, an economy is said to be in a recession when real GDP drops for two consecutive quarters.

- In the United States, The Committee defines a recession as a “significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.”

- During the post–World War II period, the average expansion has lasted 58 months, and the average recession has lasted about 11 months.

Price Level Changes¶

- Inflation: An increase in the average level of prices.

- Deflation: A decrease in the average level of prices.

- In an economy experiencing inflation, most prices are likely to be rising, whereas in an economy experiencing deflation, most prices are likely to be falling.

- Inflation reduces the value of money and it reduces the value of future monetary obligations. It can also create uncertainty about the future.

- Because inflation reduces the purchasing power of money, the threat of future inflation can make people reluctant to lend for long periods.

- Hyperinflation An inflation rate in excess of 200% per year.

- Price index: A number whose movement reflects movement in the average level of prices.

- Base period: A time period against which costs of the market basket in other periods will be compared in computing a price index.

- Price index = current cost of basket / base-period cost of basket.

- Consumer price index (CPI): A price index whose movement reflects changes in the prices of goods and services typically purchased by consumers.

- CPI = current cost of basket / 1982–1984 cost of basket.

- Implicit price deflator: A price index for all final goods and services produced; it is the ratio of nominal GDP to real GDP.

- Implicit price deflator = nominal GDP /real GDP.

Unemployment¶

- Failure to fully employ factors of production leads to a solution inside the production possibilities curve in which society is not achieving the output it is capable of producing.

- In measuring unemployment, we thus focus on labor rather than on capital and natural resources.

- Labor force: The total number of people working or unemployed.

- Unemployment rate: The percentage of the labor force that is unemployed.

- The Bureau of Labor Statistics defines a person as unemployed if he or she is not working but is looking for and available for work.

- The unemployment rate is then computed as the number of people unemployed divided by the labor force—the sum of the number of people not working but available and looking for work plus the number of people working.

- Problems with the employment survey:

- Women were asked about house keeping, despite that they may be working/looking for work while housekeeping.

- Part-time workers are considered employed, even if they are looking for full-time work.

- Discouraged workers are not considered unemployed, even if they are looking for work. Discouraged workers are those who have given up looking for work because they believe there are no jobs available for them, despite that they are willing to work. They are kept at a different statistic.

- Sometimes, companies ask people to work less or more hours depending on employment stats rather than hiring new people, which in turn affects the unemployment rate.

- If too many discouraged workers went back to looking for work due to a better economy or some encouragement, the unemployment rate would increase, despite that the economy is doing better.

- Natural level of employment:

- The employment level at which the quantity of labor demanded equals the quantity supplied.

- Even if the economy is operating at its natural level of employment, there will still be some unemployment.

- The rate of unemployment consistent with the natural level of employment is called the natural rate of unemployment.

- Frictional Unemployment:

- Unemployment that results because it takes time for workers to search for the jobs that best suit their tastes and skills.

- Some workers are looking for jobs, and some employers are looking for workers. During the time it takes to match them up, the workers are unemployed.

- Example: graduating students looking for jobs, they will start finding one by one, and after some time, they will all be employed.

- If information sharing between employers and employees is costless, frictional unemployment will not be existent as job seekers would be instantly matched to suitable jobs.

- Structural Unemployment:

- Unemployment that results from a mismatch between worker qualifications and the characteristics employers require.

- Some labor markets is insufficient to provide a job for everyone who wants one.

- Its caused by potential mismatches between the skills employers seek and the skills potential workers offer.

- It happens due to technological changes, or if too many or too few people are trained in a particular field.

- It happens because students do not know what the job market needs, so they may study the wrong field.

- It can be fixed by students making informed decisions about their field of study, and by employers providing training to their employees.

- It can happen due to geographical mismatch, where the jobs are in one place and the workers are in another; which can be fixed by workers moving to where the jobs are, good transportation, or relocating the jobs (if possible).

- Cyclical Unemployment:

- Unemployment in excess of the unemployment that exists at the natural level of employment.

- Unemployment that results from fluctuations in economic activity.

Introduction to Inflation 6¶

- Price inflation: the general increase in the price level of goods and services in an economy over a period of time.

- Historically, it was referring to the monetary inflation, the increase in the money supply.

- If the money supply increases faster than the real output of the economy, the price level will rise, and the value of money will fall, leading to inflation.

- The money supply is affected by:

- The amount of dollars in circulation.

- Lending.

- Number of transactions.

- Other short run causes of inflation:

- Supply shocks: A sudden increase in the price of oil, for example, can lead to an increase in the price of goods and services.

- A little of inflation is good for the economy, as it encourages spending and investment, but too much inflation can lead to hyperinflation, which can be very damaging to the economy.

- Negative inflation is called deflation, which can also be damaging to the economy.

- In the U.S, inflation is measured by the Consumer Price Index (CPI), which measures the change in the price level of consumer goods and services purchased by households.

Real GDP and Nominal GDP 7¶

- GDP: Gross Domestic Product, the total value of all goods and services produced in an economy over a period of time.

- Nominal GDP: The total value of all goods and services produced in an economy over a period of time, measured in current prices.

- Real GDP: The total value of all goods and services produced in an economy over a period of time, adjusted for inflation.

- The growth in nominal GDP can be due to an increase in the quantity, the price, or both.

- The growth due to an increase in the quantity is called real GDP growth.

- Adjusting for inflation tries to eliminate the growth due to the increase in prices, so that the real GDP growth is only due to the increase in the quantity.

Winners and Losers from Inflation and Deflation 8¶

- Inflation is Good for:

- Borrowers: They can pay back their loans with money that is worth less than when they borrowed it.

- Inflation is Bad for:

- Savers: The value of their savings decreases over time.

- People on Fixed Incomes: The value of their income decreases over time.

- Lenders: On fixed interest rates, they receive more nominal dollars, but the real value of the money they receive is less.

- Deflation is Good fD §or:

- Savers: The value of their savings increases over time.

- People on Fixed Incomes: The value of their income increases over time.

- Lenders: On fixed interest rates, they receive more nominal dollars, and the real value of the money they receive is more.

- Deflation is Bad for:

- Borrowers: They have to pay back their loans with money that is worth more than when they borrowed it.

References¶

-

Rittenberg, L. & Tregarthen, T. (2009). Principles of Economics. Flat World Knowledge. Chapter 11: The World of Imperfect Competition. https://my.uopeople.edu/pluginfile.php/1894552/mod_book/chapter/527802/Principles%20Of%20Economics%20Chapter%2011.pdf ↩

-

Khan Academy. (2012, January 30). Monopolistic competition and economic profit | Microeconomics | Khan Academy [Video]. Youtube. https://youtu.be/RUVsEovktGU ↩

-

Khan Academy. (2012, January 26). Oligopolies and monopolistic competition | Forms of competition | Microeconomics | Khan Academy [Video]. Youtube. https://youtu.be/PzDthFTzEa0 ↩

-

Khan Academy. (2012, January 31). Price discrimination | Microeconomics | Khan Academy [Video]. Youtube. https://youtu.be/z0wg9ZPyL38 ↩

-

Rittenberg, L. & Tregarthen, T. (2009). Principles of Economics. Flat World Knowledge. Chapter 20: Macroeconomics: The Big Picture. https://my.uopeople.edu/pluginfile.php/1894556/mod_book/chapter/527809/Principles%20Of%20Economics%20Chapter%2020.pdf ↩

-

Khan Academy. (2012, February 14). Introduction to inflation | Inflation - measuring the cost of living | Macroeconomics | Khan Academy [Video]. YouTube. https://youtu.be/AaR1mPrdbTc ↩

-

Khan Academy. (2012, February 10). Real GDP and nominal GDP | GDP: Measuring national income | Macroeconomics | Khan Academy [Video]. YouTube. https://youtu.be/lBDT2w5Wl84 ↩

-

Khan Academy. (2018, February 22). Winners and losers from inflation and deflation | AP Macroeconomics | Khan Academy [Video]. YouTube. https://youtu.be/V41_kZuOE0w ↩